45% of the respondents look at the ratings and reviews before shopping, said the PwC report. 37% of Urban dwellers accept that fake customer reviews are a key barrier for using other platforms in the electronics category.

The report is based on an online survey of 2,100 people, 100 qualitative interviews, and 400 in-person interviews across India with leading experts and industry partners. The insights derived from the report highlight the similarities and differences in the purchasing habits, choices and mindsets of online shoppers across the country.

Some of the key findings of the report include the following:

- 50% of consumers in metros and tier-1 cities value quick delivery, while for 54% of consumers in tier-2, 3 and 4 cities, deals and offers take precedence.

- With increasing financial independence, women's shopping behaviour shifted from social to individualistic across geographies as per our survey.

- Fake reviews of health and wellness products deter over 42% of tier-2, 3 and 4 cities' shoppers from making purchases in this category. They also prefer buying these products online since there are concerns related to the authenticity of these products in brick-and-mortar stores.

- More than 60% of our respondents preferred to shop using an app rather than using any website. There was a clear preference for marketplace apps since they cater to many categories.

- YouTube emerged as a clear winner when it comes to a reliable platform (discovery. information, usage experience and unboxing videos) for making buying choices.

- Interestingly, Gen Z prefers cash on delivery (CoD) in tier-2, 3 and 4 cities.

Beyond the urban landscape, a new trend is rapidly unfolding in India – tier-2, 3, and 4 cities – where aspirations have begun to surge, and shopping habits are undergoing a transformation.

Average basket size based on last purchase

|

| Average basket size based on last purchase |

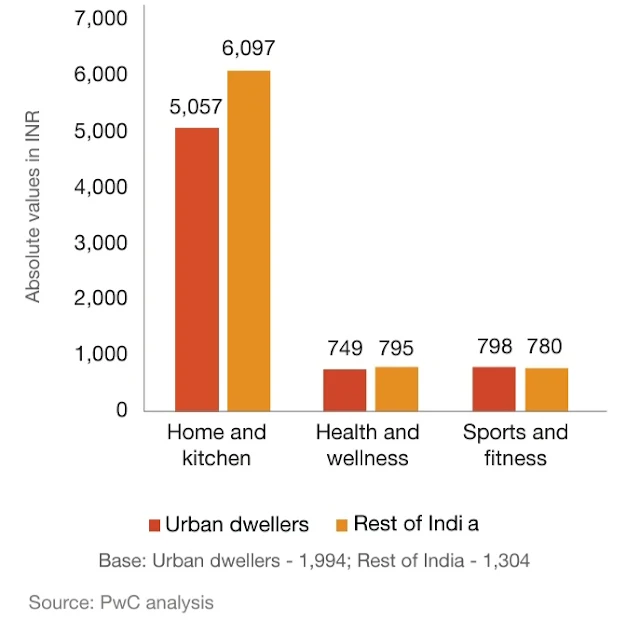

The report also elucidates the disparities in e-commerce shopping patterns between urban and rural India. A significant shift is observed in the shopping behaviours of consumers from tier 2, 3, and 4 cities, compared to their urban counterparts. While urban dwellers are enticed by perennial discounts and convenience of online shopping, consumers from rest of India regions are driven towards online shopping by factors such as limited product availability and stockouts in local offline stores.

The preference of Apps

Over 60% of surveyed respondents prefer shopping via mobile apps due to ease of navigation, user-friendly interfaces, and vernacular support, highlighting the importance of app-based platforms in India's e-commerce landscape.Social Media Influence

Social media platforms play a pivotal role in driving product trials, with 62% of users trying products after seeing them on platforms like Facebook and Instagram. Urban and rest of India consumers exhibit differing preferences in social media channels for product discovery and trials.Payments Preferences

|

| Mode of Payment |

While both urban dwellers and rest of India consumers display comparable acceptance of UPI payments, cash on delivery remains the preferred option among the latter to minimise fraud risks. Generation X from rest of India regions prefers card transactions for mid-high value purchases, citing transaction safety as a key factor.

Category Preference

|

| Categories purchased |

The report delves into specific category preferences among consumers, highlighting varying trends in fashion, sports and fitness, electronics, home and kitchen, beauty and personal care, health and wellness, and grocery segments. In these categories, urban dwellers prefer online shopping for its quick delivery which meets their demand for instant gratification, even if it means paying a premium. In contrast, Rest of India consumers are more focused on finding the best deals and discounts online.

The report aims to help businesses not only increase market share and revenue but also make a positive difference in the lives of millions of consumers in India. By embracing empathy, businesses can tap into the human side of e-commerce and unlock the potential of a nation on the cusp of greatness.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.