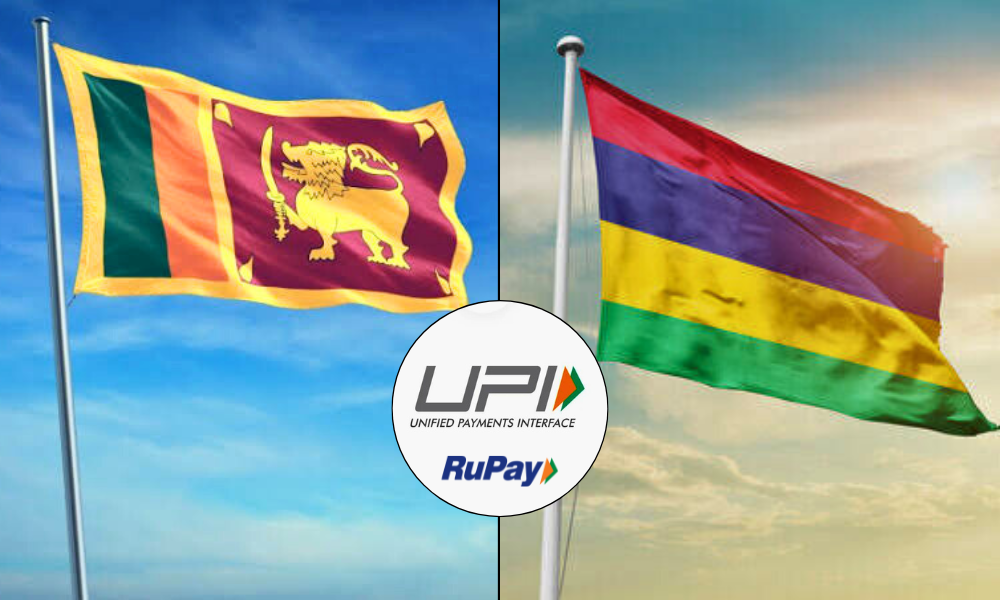

- PM jointly inaugurates UPI services with Mauritius PM & Sri Lankan President

- India’s policy is ‘Neighborhood First’. Our maritime vision is SAGAR i.e. Security And Growth for All in the Region

- By connecting with UPI both Sri Lanka and Mauritius will benefit and digital transformation will get a boost”

- After Nepal, Bhutan, Singapore and UAE in the Gulf in Asia, now from Mauritius, RuPay card is being launched in Africa.

Mauritius PM, Mr Pravind Jugnauth, informed that co-branded Rupay card will be designated as domestic card in Mauritius. This launch will greatly facilitate the citizens of both countries said the PM.

With this UPI services connectivity, an Indian traveller to Mauritius will be able to pay a merchant in Mauritius using UPI. Similarly, a Mauritian traveller will be able to do the same in India using the Instant Payment System (IPS) app of Mauritius.

Further, with the adoption of RuPay technology, the MauCAS card scheme of Mauritius will enable banks in Mauritius to issue RuPay cards domestically which can be used at ATMs and PoS terminals locally in Mauritius as well as in India. With this, Mauritius becomes the first country outside Asia to issue cards using RuPay technology. Indian RuPay cards would also be accepted at ATMs and PoS terminals in Mauritius.

The digital payments connectivity with Sri Lanka will enable Indian travellers to make QR code-based payments at merchant locations in Sri Lanka using their UPI apps.

These projects have been developed and executed by NPCI International Payments Limited (NIPL) along with partner banks / non-banks from Mauritius and Sri Lanka, under the guidance and support of Reserve Bank of India. The Bank of Mauritius and the Central Bank of Sri Lanka have also played an important role in making these possible. The above facilities have been made operational through select banks / non-banks / Third Party Application Providers in India, Mauritius and Sri Lanka. Going forward, these facilities will be scaled up.

The collaborations on India's digital payments connectivity with Mauritius and Sri Lanka through UPI and RuPay will deepen financial integration and strengthen the long historical, cultural, and economic relations of India with Mauritius and Sri Lanka.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.